Creating a monthly budget transforms financial anxiety into financial control. Most people avoid budgeting because they view it as restrictive or complicated, but a well-designed budget actually creates freedom by showing exactly where your money goes and helping you direct it toward your priorities (Consumer Financial Protection Bureau, 2025).

Why Monthly Budgeting Works

Monthly budgeting aligns perfectly with how most people receive income and pay bills. Your paycheck arrives monthly or bi-weekly, rent comes due on the first, utilities follow predictable cycles, and credit cards close on specific dates. A monthly budget captures this natural rhythm and gives you complete visibility into your financial picture.

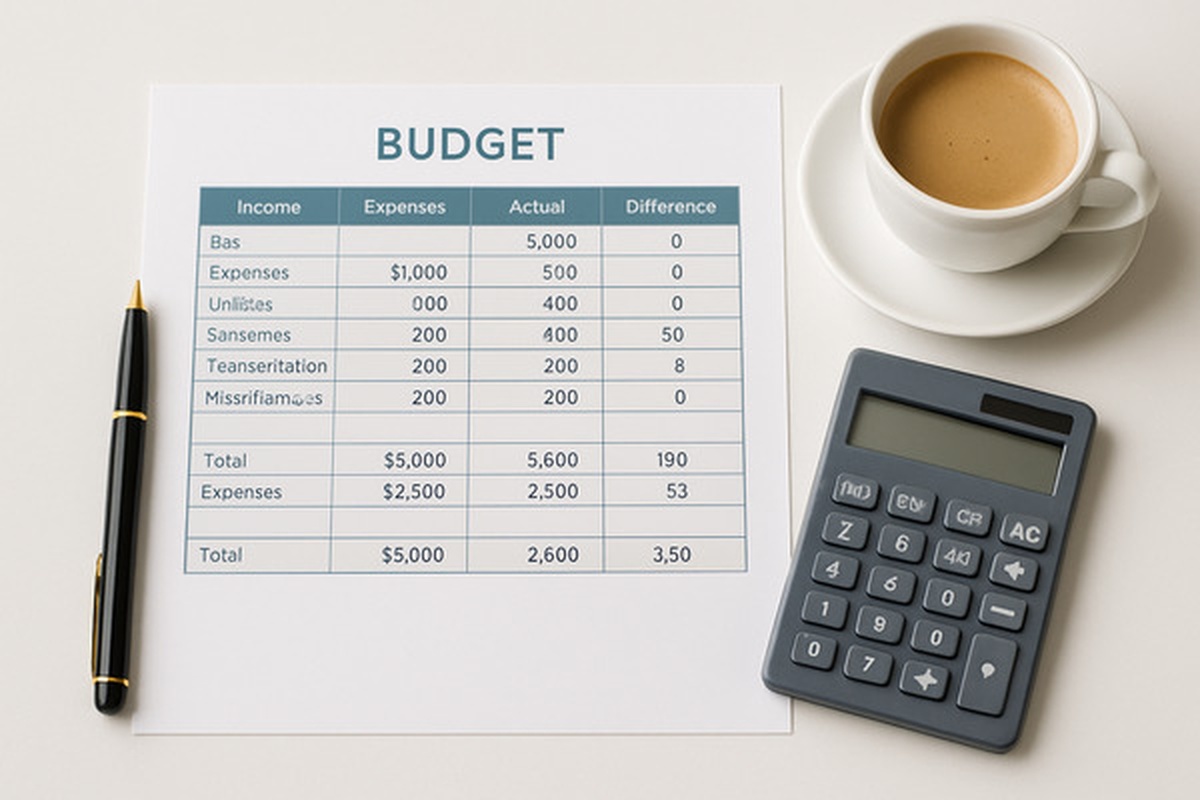

The budget template provided here breaks expenses into eight essential categories: housing, transportation, food, healthcare, debt payments, entertainment, savings, and other costs. This structure ensures you account for every dollar while maintaining enough flexibility to adapt the system to your unique situation. You track both fixed costs (rent, car payments, insurance) and variable expenses (groceries, entertainment, utilities) in one comprehensive view (National Endowment for Financial Education, 2025).

The 50/30/20 Framework

Financial experts recommend the 50/30/20 rule as a starting framework for budget allocation. Direct 50% of your after-tax income toward needs (housing, transportation, food, healthcare), 30% toward wants (entertainment, dining out, hobbies), and 20% toward savings and debt repayment beyond minimum payments (Ramsey Solutions, 2025).

This framework provides guardrails without rigid restrictions. If your housing costs exceed 30% of your income (the standard in high-cost areas), you adjust other categories accordingly. The key insight is conscious allocation. Instead of wondering where your money went at month’s end, you decide beforehand where it should go and track whether reality matches your plan.

Taking Action With Your Budget

Start by tracking your spending for one month without changing your behavior. This baseline reveals your actual patterns rather than idealized versions. Next, categorize every expense using the template structure. Third, identify areas where spending exceeds your comfort level or financial goals. Fourth, set realistic targets for each category based on your priorities. Finally, review your budget weekly for the first month to catch surprises and adjust projections.

Your budget serves as a living document, not a static constraint. Life changes, expenses fluctuate, and priorities shift. Review and adjust your budget monthly, celebrating progress toward savings goals while honestly addressing challenges. The template includes automatic calculations showing your savings rate and remaining balance, providing instant feedback on your financial health.

Building Your Financial Foundation

Budgeting is the foundation of financial literacy and the starting point for achieving other financial goals. You cannot effectively save for emergencies, invest for retirement, pay off debt, or plan for major purchases without understanding your current cash flow. This template gives you that understanding through simple, strategic tracking that requires just minutes per week to maintain (Jump$tart Coalition, 2025).

💰 Monthly Budget Template

Take control of your finances with Tactical Legacy

Total Monthly Income

Total Monthly Expenses

Remaining Balance

Savings Rate

• Aim for a savings rate of at least 20%

• Housing should be no more than 30% of income

• Keep total debt payments under 36% of income

• Build an emergency fund of 3-6 months of expenses

References

Consumer Financial Protection Bureau. (2025). Making a budget. https://www.consumerfinance.gov/consumer-tools/budget-worksheet

Jump$tart Coalition. (2025). Financial education resources. https://www.jumpstart.org

National Endowment for Financial Education. (2025). Budgeting basics. https://www.nefe.org

Ramsey Solutions. (2025). How to budget money. https://www.ramseysolutions.com/budgeting/how-to-budget